How to classify the impact of a portfolio: Applying the IMP framework to a public-equity fund

October 25th 2023

By Jorge Alarcón Martín and Sophie Chauliac

Consultants at Stone Soup

This year Stone Soup Consulting has been working with Eleva Capital to elaborate the impact report of its public-equity impact investing fund: the Eleva Sustainable Impact Europe fund. With 43 stocks in portfolio, the mission of the fund is to generate attractive risk-adjusted returns while intentionally investing in European listed companies that contribute to the achievement of the UN Sustainable Development Goals (SDGs) through the products and services they sell. The fund embeds in its portfolio the so-called “Scale up pocket”, a group of investee companies featured by a smaller size (< 3€ bn in market capitalization) while offering breakthrough products or technologies with the potential to generate a systemic impact. Such is the case of Carbios, the first and only company in the world to have developed an enzymatic process that recycles plastics and textiles at an unprecedented speed.

Thus, we relied on the IMP (Impact Management Project, now Impact Frontiers) framework to undertake a portfolio-level analysis of the impact of the investments of the fund and map it. The IMP framework has emerged from a wide-ranging consensus among impact investors across the world and it remains the most widespread tool among investors to measure and manage their impact, be it at the portfolio, fund or investment level.

The IMP-based methodology developed by Stone Soup for Eleva Capital’s impact fund lies on three steps:

- Understand that the IMP impact classes are a combination of the impact of the asset or the investee company and the contribution of the investor to this impact:

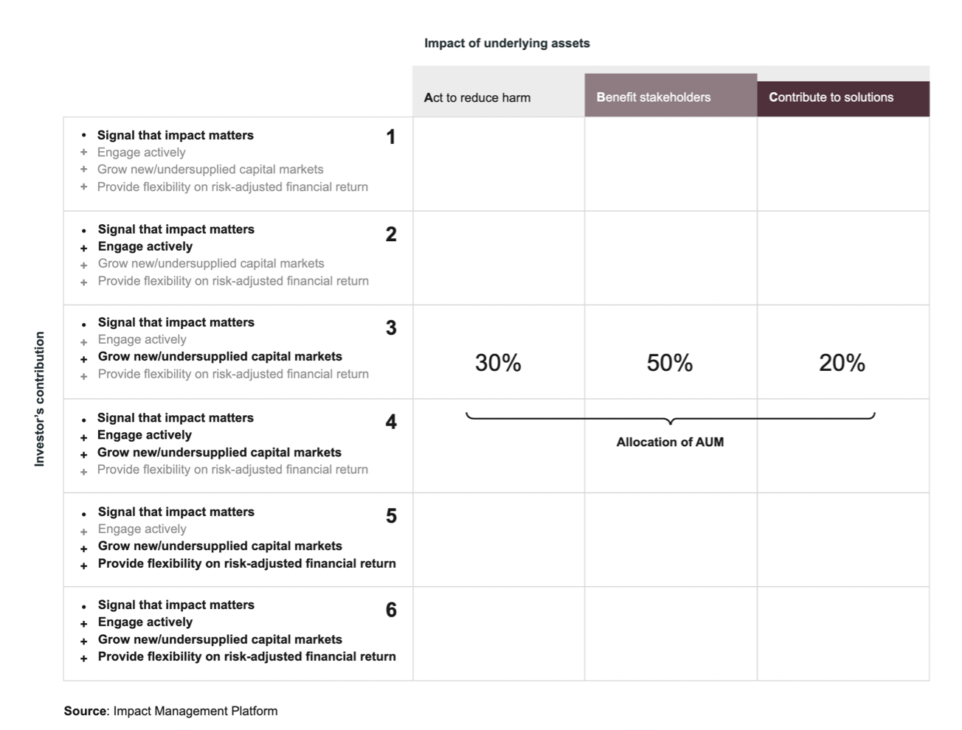

On the one hand, the contribution to impact of the investee as the object of the investment is framed by the IMP as 3 categories with increasing level of impact for people and the planet:

A: Act to avoid harm

B: Benefit stakeholders

C: Contribute to solutions

On the other hand, the contribution of the investor with their investment to the impact is framed by the IMP in 4 categories, understood as the 4 possible ways in which investors may deliver their impact, with a non-exclusionary nature that permits the combination of several of these categories:

- Signal that impact matters: when an investor proactively and systematically considers measurable positive and negative impacts of assets as part of their decision-making processes and communicates this consideration.

- Engage actively: when an investor goes beyond 1. and proactively supports or advocates for assets to reduce negative and increase positive impacts.

- Grow new or undersupplied capital markets: when an investor participates in new or previously overlooked opportunities, usually taking the form of an increased supply of capital or a reduced cost of financing for the investee enterprise that unlocks impact.

- Provide flexibility on risk adjusted financial return: when an investor accepts a lower- than-market-average financial return in order to generate more impact.

The IMP has combined both categorisations (investee impact & investor impact) into an Impact classes matrix (see below), which brings together the impact performance of the assets being invested in and the strategies an investor may use to contribute to this impact. It groups investments with similar characteristics and gives an impact overview of a portfolio.

Example of AUM allocation according to the IMP framework:

2. Develop our own in-house qualitative methodology

The IMP is not prescriptive of a methodology to classify a portfolio along the impact classes and each investor can develop its own fit-for-purpose methodology. Therefore, Stone Soup, in dialogue with ELEVA Capital, developed its own methodology to best tailor the IMP classification of Eleva’s portfolio to the specificities of its impact thesis and impact investing practice.

Impact of underlying assets:

As a starting point, we considered that all stocks within the Eleva Sustainable Impact Europe fund qualify at least for the B category, as the impact fund combines three selection filters leading portfolio managers to select companies: exclusion of sectors having essentially negative impacts, minimum ESG score of 60 out of 100 and minimum SDG score of 20%. The SDG score of a company as defined by Eleva Capital represents the percentage of its revenue that contributes to the achievement of the SDGs.

To evaluate whether an investee belongs to the C category we took into consideration a set of 4 criteria: a minimum SDG score of 51%, no negative contribution to any SDG, at least one strong social or environmental commitment (i.e engaged towards setting an SBTi target or already with an approved target and/or is a signatory of the UN Global Compact). We considered that the 5 companies within the Scale-Up pocket automatically classify as C due to their unique nature that intrinsically delivers enhanced impact.

Contribution made by the investor

We considered that the contribution of the fund classifies at least as “1” “signal that impact matters” given its positioning. Also, the fund does not provide flexibility on risk-adjusted return, which narrows its categories of contribution, thus excluding 5 or 6. To determine whether the contribution of Eleva qualifies as “2”, “3”, or “4””, we analysed the portfolio against a set of 3 criteria:

- For companies that have been in the portfolio for several years and with past engagement record, at least one ESG engagement topic has to be “achieved” to qualify for the “Engage actively” category.

- For the newest companies with no engagement track record yet, we considered that the engagement is active if there is at least one engagement topic on E (Environmental), S (Social) or Impact, which are Eleva’s categories for its engagement activities.

- We considered that the contribution of the fund classifies as “Grow new or undersupplied capital markets” for the companies within the Scale-up pocket since they, because of their very nature, deliver impact through their business model and their revenue is expected to double within 36 months. In addition, ELEVA Capital also intends to participate in their capital increases, if need be, and provided they fit their financial criteria.

3. Calculate the Assets Under Management for each category

Knowing to which impact class each company of the portfolio belongs we were able to allocate its corresponding weight of the total portfolio. We found that the portfolio could be broken down into only 3 categories: 44.5% of the Assets Under Management (AUM) are B2, 47.6% are C2 and 4.7% are C4.

In conclusion, Eleva Capital’s impact report for its public-equity fund represents a milestone in Eleva Capital’s journey as an impact investor. The incorporation of a fit-for-purpose IMP classification of the fund’s portfolio, new this year, further articulates the impact investing practice of Eleva Capital and provides for the transparency and accountability that is so important in the market.

For more information, here’s the Eleva Sustainable Impact Europe fund Impact report

“Stone Soup Consulting – an international consultancy and B Corporation whose mission is to optimize the social impact of organisations. Subscribe to our newsletter and follow us on Linkedin, Facebook and Twitter.”